- Solana builders set to launch improve v1.9.28/ v1.10.23 to stop the blockchain from halting if sturdy nonce transactions fail.

- Ethereum and Solana networks are being actively drained as establishments pull out of ETH and SOL to pour capital into the Cardano community.

- Analysts have recognized a reversal sample in Solana, alongside bullish divergence and predict a rally to $50-$52 ranges.

Solana blockchain is protected in opposition to halts and outages with an upcoming improve for sturdy nonce transactions. Institutional capital is flowing out of Solana to the Ethereum-killer Cardano community. Analysts stay bullish on the Solana worth rally.

Additionally learn: Solana worth dives beneath $40 after second community outage in a month

Solana blockchain to witness improve, safety in opposition to outages

The Solana blockchain was halted not less than seven instances over the previous twelve months because the community suffered outages that lasted a number of hours. The newest occasion when Solana blockchain went offline was a results of failure to course of sturdy nonce transactions accurately.

Builders have give you launch v1.9.28/ v1.10.23 that stops the Solana blockchain from halting if the identical concern [durable nonce transaction processing error] happens once more.

Solana makes use of parallel processing for non-overlapping transactions to enhance its throughput. Sturdy nonce transactions don’t expire and require a distinct mechanism than regular transactions to stop double processing. Such transactions use an on-chain worth particular to every account that’s rotated each time a transaction is processed. Subsequently, after worth rotation, the identical transaction shouldn’t be processed once more.

Nonetheless, over the last outage, a sturdy nonce transaction was processed whereas its blockhash was current sufficient for it to be handled as a traditional transaction on the Solana blockchain.

Transaction processing failed, transaction charges had been paid, and the person resubmitted the failed transaction to the blockchain. The “resubmission” of the sturdy nonce transaction activated a bug within the runtime surroundings. That is addressed within the subsequent launch by Solana builders.

Cardano drains institutional capital from the Solana community

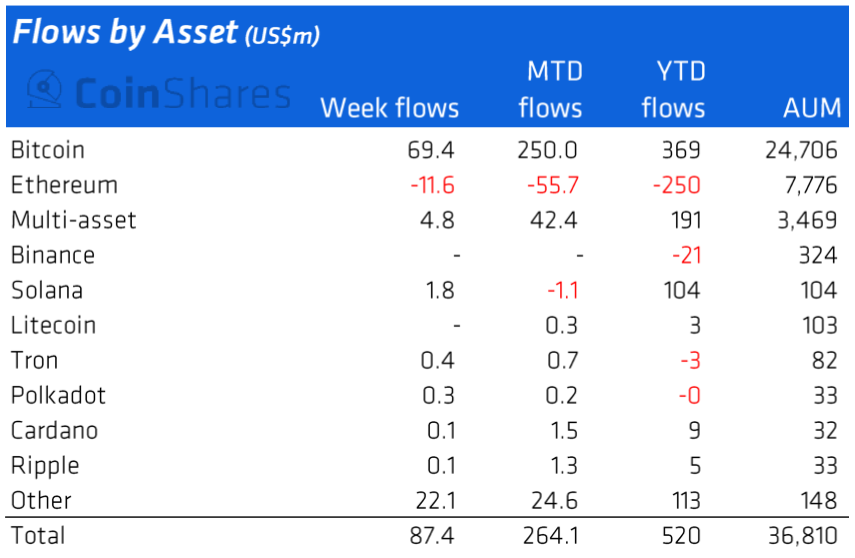

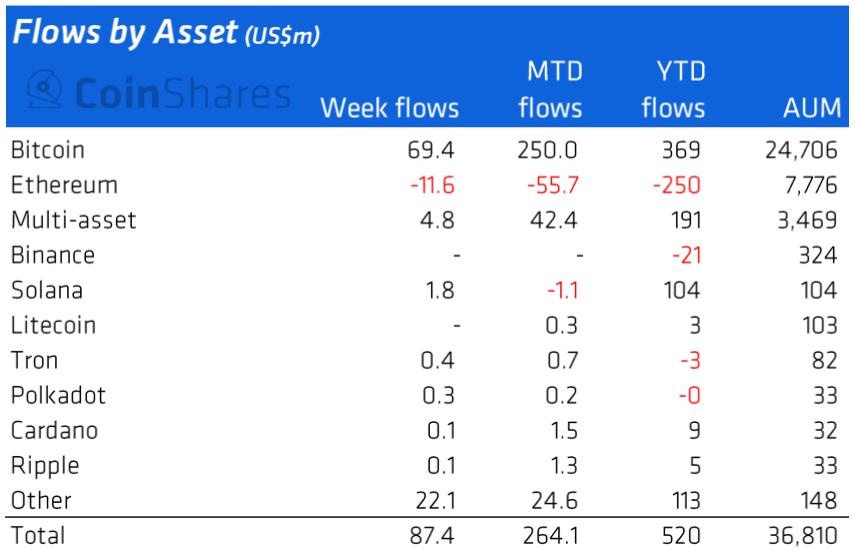

Primarily based on information from a Digital Asset Bi-Month-to-month Fund Supervisor report by CoinShares, there may be a rise in institutional capital influx to Polkadot, Cardano and XRP on the expense of Ethereum and Solana.

There’s a vital discount in positions in Solana, falling from 4% weightage to 1%, regardless of a “low warning” ranking from CoinShares. The report highlights that establishments are reallocating their funds to Cardano, transferring out of Ethereum and Solana.

The key theme is reallocation and never influx of funds to the altcoins. CoinShare’s weekly Digital Asset Funds Flows revealed a $1.8 million weekly influx to the Solana blockchain. Subsequently, the concern is capital rotation by establishments and never an total dearth of inflows to Solana.

Capital flows by asset from CoinShares weekly fund circulation report

Solana worth targets $50 in new uptrend

Analysts have evaluated the Solana worth development and famous that the devaluation from the $85 mark indicated a bear run and a 62.5% weekly decline. Solana worth hits its nine-month low, approaching help at $38 with mounting promoting stress. US Solana worth recovers from the hunch, analysts predict a potential bounce-back alongside the reversal sample.

A key indicator, the idea line of Bollinger Bands, seems south and affirms the bearish edge. Analysts consider the falling wedge setup might be adopted carefully by a breakout to the $50-$52 vary.

Indicators on Solana worth chart

@Pentosh1, a pseudonymous cryptocurrency analyst, believes chances and historic traits predict a rally in Solana worth. The analyst has set a goal of $58 to $60 for Solana worth.

FXStreet analysts evaluated whether or not Solana worth can recuperate from the current community outage. For extra info watch this video: