gorodenkoff/iStock via Getty Images

Progress Software (NASDAQ:PRGS) recently announced its proposed acquisition of privately held on-premise NoSQL database vendor MarkLogic for $355m cash (webcast here). The implied 3-4x EV/Sales valuation seems slightly pricey given the low-single-digit % growth profile, but the sticky, high retention customer base fits well within the PRGS acquisition playbook. And while management hasn’t embedded much in the way of cross-selling synergies, the cost synergy opportunities should help the company eventually achieve a net accretive outcome (albeit not in the short-term).

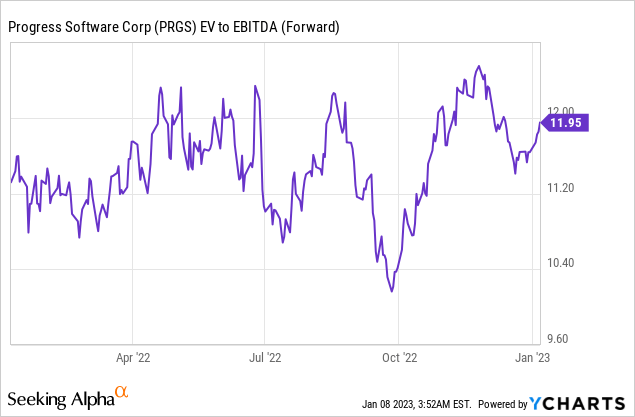

The stock was up on the M&A news, however, valuation multiples are still well below their historical medians; this seems fair given the slugish organic revenue growth in recent quarters and the limited cost levers available. For the stock to work over the near to mid-term, PRGS will need to accelerate the rollup pace, in my view, particularly with private software company valuations significantly reset in a higher rate environment. And with the payout ratio likely to stay relatively low, the company should have more than enough dry powder available. At this juncture, though, the ~12x EBITDA valuation is probably fair for a mid-single-digit % EPS grower, and I would remain sidelined.

Acquiring MarkLogic for $355m

Having acknowledged the slowdown in deal flow through Q2, PRGS had signaled it was picking up the pace on its Q3 call while sticking to its emphasis on recurring revenue and high retention rates. The latest acquisition of MarkLogic tallies with management’s commentary, although the deal size at $355m, was a tad surprising. The company has enough cash on hand to fund this deal but will also tap into its existing revolving credit facility for ~$200m. The deal is guided to close later next month.

For context, MarkLogic’s key offering is its AI-integrated NoSQL database, primarily serving as an operational and analytical data hub for its ~300 customers to manage unstructured and structured data. MarkLogic cleared ~$100m in annual revenue, of which ~$75M is recurring, implying a 3-4x EV/Revenue valuation. While this is in line with prior transaction comps for PRGS, the multiple appears a tad pricey relative to a flat to low-single-digit growth profile.

The Profile Fits, but Near-Term Accretion is Likely Limited

The added scale from this acquisition is a bonus at >$100m in annual revenue and $75m of recurring revenue, but the margin opportunity is key. Management sees a clear path to getting MarkLogic to pro-forma operating margins of >40% (post-synergies), which should translate into strong cash flows. Of note, MarkLogic’s recurring revenue contribution has been growing on the back of a strong gross retention rate of >90% and net retention at ~100%. With the professional service revenue share declining in tandem, the margin tailwinds from this mix shift alone should get PRGS most of the way to its target margin.

That said, it’s hard to see the addition of MarkLogic being near-term accretive. Post-acquisition, the pro-forma entity will have a higher contribution from lower-margin professional services revenues, resulting in EPS dilution. Execution will be key here, and CEO Gupta’s strong integration track record will be a source of comfort for investors. Plus, this is an asset run by private equity (Vector Capital), so most of the heavy lifting in optimizing the financial profile has likely been completed.

On the other hand, there are likely cross-selling benefits from the complementary fit with PRGS’ existing OpenEdge and DataDirect offerings. For now, though, management has refrained from embedding much revenue synergies within the pro-forma model – a prudent move given these rarely come easy. While I do acknowledge that recent efforts to foster increased inter-team collaboration and boost operational efficiency are progressing well, whether this ultimately translates into a more effective integration process remains a key unknown.

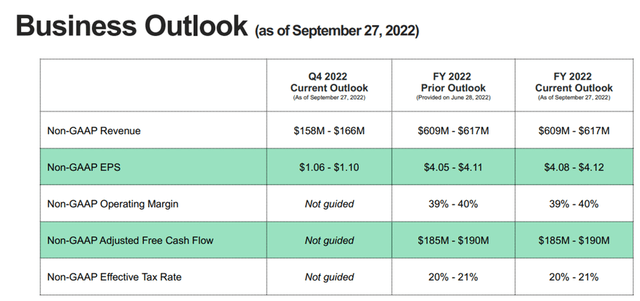

Tracking Well Against Q4 Guidance

Alongside the M&A update, PRGS also reaffirmed its Q4 recurring revenue guidance of $497m (+3.5% YoY), marking yet another quarter of low-single-digit % organic growth. Perhaps more importantly, the company also sees Q4 revenue and non-GAAP EPS potentially coming in above the upper end of its prior guidance range ($158-$166m of revenue and $1.06-$1.10/share of EPS). The extent of the FX impact is worth noting, though – PRGS has consistently raised its FX-neutral growth guidance throughout this year but maintained its guidance in dollar terms. Meanwhile, the operating margin and FCF guidance remained unchanged as management continued to streamline costs to mitigate pressures from the ongoing wage inflation.

Progress Software

Restarting the M&A Engine with MarkLogic Acquisition

PRGS’ latest acquisition of MarkLogic, an on-premise NoSQL database vendor, marks a return to the rollup playbook. This is an asset that brings a sticky customer base, albeit at the expense of growth. While there may well be opportunities to extract expense synergies post-deal, the $355m all-cash price tag (implied 3-4x EV/Sales) sets a high bar, and execution will need to be on point, given the low growth profile .

As for PRGS stock, the current ~12x fwd EV/EBITDA isn’t cheap for a mid-single-digit EPS growth story, and the onus will be on the inorganic growth strategy to accelerate from here. Backed by a strong balance sheet and limited dividend commitments, the company is well-positioned in this regard; the reset in private software company valuations over the last year presents attractive buying opportunities. Pending visibility on the future M&A-driven growth potential, however, I remain neutral at these levels.