A revolution that began with a snowflake has become an avalanche, and will result in a change in the way in which Individuals pay for his or her providers.

The software program trade helped deliver in regards to the “subscription economic system,” with companies paying for cloud-delivered providers on a month-to-month foundation as a substitute of shopping for boxed software program simply as customers moved from shopping for DVDs to subscribing to streaming providers. Now, software program is transferring in a unique path: charging for the way a lot software program a buyer makes use of as a substitute of a base payment each month.

“It is as large a shift as from on-premises to cloud and subscription. And we count on that to proceed,” Kyle Poyar, a researcher at OpenView Enterprise Companions and writer of an influential report on usage-based pricing, advised MarketWatch.

Authorities businesses and enterprise prospects together with Clorox Co. CLX,

and CVS Well being Corp. CVS,

are paying for or contemplating enterprise software program as customers pay a water invoice. The observe was popularized in software program by Snowflake Inc. SNOW,

a cloud-database software program firm that had one of many largest preliminary public choices of 2021, attracting funding even from Berkshire Hathaway Inc. BRK. B,

BRK. A,

regardless of Warren Buffett’s well-known aversion to younger expertise firms and their outsize valuations.

A balky economic system, which has compelled belt-tightening by firms small and huge — together with Fb guardian firm Meta Platforms Inc. META,

Alphabet Inc.’s GOOGL,

GOOG,

Google, Amazon.com Inc. AMZN,

Intel Corp. INTC,

and others — has hastened the soar to consumption pricing. The pay-as-you-go strategy has been dismissed by some analysts as a legal responsibility for suppliers, since prospects may rapidly scale back spending throughout tight instances, however subscription-model leaders Salesforce Inc. CRM,

and ServiceNow Inc. now,

are edging towards a consumption-based mannequin with new choices whereas reporting a slowdown in new enterprise.

For extra: Cloud software program is a ‘battle for a knife within the youth,’ and Wall Avenue is souring on the one sector that was profitable

“Because the market turns into extra unsure, companies spend money on issues they’ve extra management over,” SAP SAP,

govt board member Scott Russell advised MarketWatch. “Everybody is concentrated on effectivity and automation.”

Phil Boland, supervisor of expertise acquisition versatile workforce at Navy Federal Credit score Union, has used a SAP product since 2016.

“Our consumption mannequin utilization rises and falls with market rates of interest as we’re a monetary establishment. As charges enhance, our product demand usually diminishes, which in flip, decreases our hiring demand,” he advised MarketWatch. “With the consumption mannequin, this permits for a drop in value commensurate with utilization with out reopening contracts. If your small business has giant swings in demand, the consumption mannequin may go on your shopper.”

The altering economic system

The soar to a subscription economic system, one in every of tech’s most necessary developments previously decade, has been fueled largely by the rise of cloud computing and streaming providers. Additional influencing the change is the emergence of pricing professionals inside firms resembling Adobe Inc. ADBE,

Field Inc. BOX,

and Splunk Inc. SPLK,

who’re tasked with optimizing software program expenditures.

“Just like the Liberty Mutual advert says, solely pay for what you want,” says Constellation Analysis analyst Doug Henschen, summing up the trajectory of the software program licensing deal — from the 5-year deal negotiated over a Martini lunch to the 3-year software program -as-a-service (SaaS)/cloud deal to the present long-term consumption mannequin of as much as three years.

“That is inflicting the broader market to alter the way in which they consider pricing fashions,” AT&T Inc. T,

Chief Know-how Officer Jeremy Legg advised MarketWatch.

In a way, it already has cellphone plans, cloud computing and streaming plans, however the pattern may ripple into the broader economic system past software program. The best way customers pay their energy payments may quickly prolong to different areas of the economic system.

“If we distinguish between a pure metered/consumption mannequin (ie the taxi meter) and a capability mannequin (pre-purchased ‘credit’ to spend the way you need), I may see numerous issues going the way in which of the capability mannequin,” Andy Macmillan, CEO of Person Testing, advised MarketWatch in an e mail.

“Perhaps that is how we purchase media and TV sooner or later (ie $65 to spend on reveals throughout any set of providers or for the articles you learn anyplace),” he stated. “Automotive leases may go this fashion as properly (pay for what you drive). I’ve additionally questioned if a number of the direct-to-consumer manufacturers for issues like clothes may go this route. Kind of like Trunk Membership, the place you get a field of preselected garments for buy however reasonably you put on it a few times and ship it again. You pay for the utilization of the garments, not for the asset itself.”

“It offers customers a greater learn on worth level,” Macmillan stated.

‘Saving cash and ease of use’

Cloud stalwarts Amazon Net Providers, Microsoft Corp.’s MSFT,

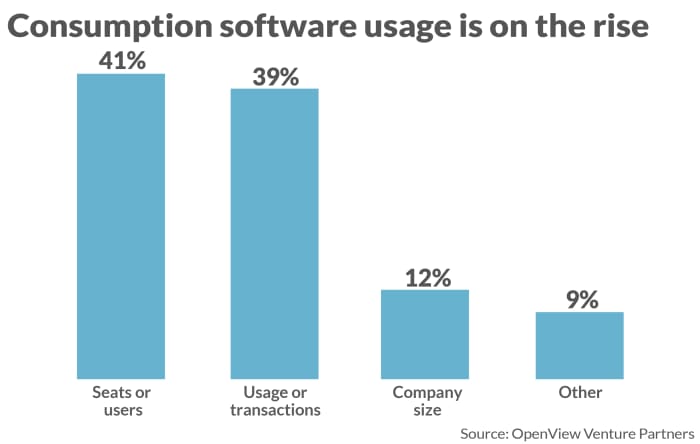

Azure and Google Cloud have charged prospects based mostly on how a lot server house is used for years. However that pricing mannequin is spreading to extra software program providers — 45% of SaaS suppliers now supply usage-based pricing, with that quantity anticipated to rise to 56% in 2023, based on the 2021 SaaS pricing survey from OpenView Enterprise Companions.

Additionally learn: How Amazon created AWS and altered expertise ceaselessly

“Out high two resolution components: Saving cash and ease of use,” Becky Crow, director of accounting at Amarok, a maker of electric-fence safety programs that switched from a subscription mannequin to consumption strategy this yr, advised MarketWatch.

The quantity is perhaps even larger if some customers weren’t dissuaded from utilizing the service by regularly climbing prices — also referred to as the “taxi-meter impact,” based on the OpenView report.

The pattern is particularly important as the federal government, a colossal buyer of software program, is diving into the consumption mannequin. Final yr, the Normal Providers Administration (GSA) continued to craft a draft coverage that will let businesses purchase cloud providers “by the drink.” “GSA anticipates buying cloud computing on a consumption foundation will enhance competitors, because the transfer towards business practices will encourage new entrants to the FSS program,” Jeff Koses, GSA’s senior procurement govt, wrote in a coverage observe, as reported by Federal Information Community.

Whereas software program subscriptions are calculated based mostly on seats or customers; the consumption mannequin is based on precise utilization of computing energy, storage, community capability, and different measurable information. The trick with consumption is precisely monitoring useful resource use inside a hard and fast price range: You possibly can overestimate or underestimate utilization, trade analysts say.

Uncredited

Snowflake Chief Income Officer Chris Degnan thought-about in an interview with Bloomberg this yr that it was “not straightforward” to promote consumption-based merchandise to firms unfamiliar with the idea. Snowflake, which declined to remark for this text, was compelled to construct its personal billing system, since most fee processors have been geared towards dealing with subscriptions, Degnan stated.

‘This isn’t a radical concept’

Now, different software program suppliers are making the swap from a subscription-based service to consumption, together with Twilio Inc.

TWLO,

New Relic Inc.

NEWR,

Tom Siebel’s C3.ai Inc. AI,

and Autodesk Inc. ADSK,

A Greek refrain of tech executives advised MarketWatch that usage-based pricing is turning into important of their product instrument equipment, together with — sure — functions.

“This isn’t a radical concept. Snowflake, Databricks , Azure, Google, AWS are all doing it,” Siebel advised MarketWatch. As gross sales cycles slowed down, his enterprise software program supplier switched all new enterprise to consumption pricing as a result of it was simpler for purchasers, cheaper and required much less govt approval. “In a recession, it’s essential discuss pennies, not hundreds of thousands,” he stated.

“It is rather a lot part of who we’re,” David Trice, Honeywell Related Enterprise’s HON,

chief product officer, advised MarketWatch, calling pay-as-you-use-software a staple in its contracts with warehouse prospects, for instance.

See additionally: Enterprise capital traders see an ‘R’ phrase coming for tech — and it is not only a recession

Final yr, computer-aided design pioneer Autodesk launched one-day “Flex” licenses that permit customers of AutoCAD pay $21 day by day for the app reasonably than a normal $235 month-to-month subscription. Now, Autodesk prospects usually mix each subscription plans and pay-as-you-use Flex apps.

“It is a highly effective instrument for small companies that may’t afford a full subscription to the whole lot we do,” Autodesk CEO Andrew Anagnost advised MarketWatch. “I believe finally, most everybody’s going to finish up in some type of consumption plan.”

Certainly, the Flex plan has allowed one buyer to have the ability to add flexibility and affordably to their workforce.

“Subscription limits the person base. What occurs is a few of these functions are considerably costly and user-based, not project-based,” stated Mark Schulz, director of CAD operations at Bolton & Menk Inc., an Autodesk buyer that gives public infrastructure options for greater than 100 communities within the higher Midwest. “The pay-as-you-go mannequin is a large plus, giving the app publicity to everybody.”