The outlook for the Web-Software program & Companies trade seems blended. The lackluster efficiency in direction of the start of the 12 months is especially associated to the lingering results of the pandemic, which has harm quite a few gamers. Estimates have been growing since Might, because the pandemic recedes. Some firms had been nonetheless positively impacted by the pandemic and the rush-to-digitize development that it gave rise to. The range of gamers on this group results in some dissonance.

Being the spine of the digital economic system, it is onerous to see this trade doing badly over the long run. Total, a few of these long-term tendencies are enjoying out this 12 months whilst considerations of a slowing economic system in 2023 loom giant. The detrimental financial indicators, inflation and geopolitical tensions have an effect on most gamers however some are higher geared up than others to take care of the scenario.

Regardless of the beating that the trade has taken this 12 months, the valuation nonetheless appears to be like wealthy. However this can be simply the time to seek out beaten-down shares with higher endurance or sturdy long-term potential. Our picks are NetEase (NTES), RingCentral (RNG) and Verisign (VRSN).

About The Business

The Web Software program & Companies trade is a comparatively small trade, primarily concerned in enabling platforms, networks, options and companies for on-line companies and facilitating buyer interplay and use of Web primarily based companies.

High Themes Driving the Business

-

The general impression of COVID has been blended for the trade. Though it necessitated make money working from home for workers, the trade, being by nature tech-centric, had comparatively few points with this. Then again, enterprise continuity considerations accelerated the shift to cloud-based working for a lot of firms, whereas service suppliers, each work-related and in any other case, additionally moved to Web-based channels. One other massive phase that did humongous quantities of on-line enterprise was retail. All of those strikes had been optimistic for the trade (by way of income) and partially offset the detrimental impression of declining enterprise at brick-and-mortar gamers. Not less than a number of the positives will outlive the pandemic. In different instances, the return to bodily operations continues to be ongoing, and hindered by new strains of the virus, inflation and different considerations.

-

The geopolitical tensions in Europe have a bearing on oil costs and sure provide chains, and subsequently additionally on giant segments of the economic system. And most specialists concern that the Fed’s actions to include inflation are pushing us right into a recession. Since any enchancment on the normal stage of financial progress improves prospects for the trade, the present surroundings is contributing to a detrimental outlook for 2023.

-

The upper quantity of enterprise being operated by way of the cloud and the growing demand for enabling software program and companies involving infrastructure buildout, which will increase prices for gamers. This causes nice fluctuations in profitability as new infrastructure is depreciated and recent debt is serviced. So even for these gamers who’ve seen income progress speed up on account of the pandemic, profitability has remained a problem. The present inflationary situations are additionally a priority.

-

The extent of know-how adoption by companies and the proliferation of related client gadgets that may assist folks join and do enterprise on-line additionally impacts progress. The excessive penetration of cell gadgets amongst customers and the pandemic-driven necessity is driving extra companies to undertake know-how that they earlier stayed away from due to the fee concerned. That is optimistic for the trade.

Zacks Business Rank Signifies Bettering Prospects

The Zacks Web – Software program & Companies trade is housed inside the broader Zacks Pc and Expertise sector. It carries a Zacks Business Rank #93, which locations it within the prime 37% of greater than 250 Zacks categorized industries. Our analysis reveals that the highest 50% of the Zacks-ranked industries outperform the underside 50% by an element of greater than 2 to 1.

The group’s Zacks Business Rank, which is mainly the typical of the Zacks Rank of all of the member shares, signifies that the trade is at present in restoration mode.

The trade’s positioning within the prime 50% of Zacks-ranked industries is as a result of the earnings outlook for the constituent firms in mixture is enhancing. The mixture estimates revisions mirror elevated analyst optimism since Might and the group’s mixture earnings at the moment are down simply 1.6% over the previous 12 months. The 2023 estimate is nonetheless nonetheless down 35%.

Earlier than we current a couple of shares that you could be need to contemplate to your portfolio, let’s check out the trade’s current stock-market efficiency and valuation image.

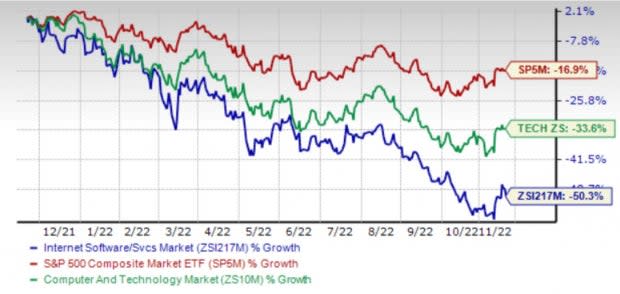

Business’s Inventory Market Efficiency Stays Poor

The previous 12 months’s efficiency of the Zacks Web – Software program & Companies Business reveals that it has lagged the broader Zacks Pc and Expertise Sector, in addition to the S&P 500 throughout this era. However whereas the low cost to the S&P 500 is substantial, particularly in the previous few months, it has traded nearer to the sector, which hasn’t had an amazing run within the face of present macro considerations.

The mixture value share of the trade dropped 50.3% over the previous 12 months in comparison with the broader sector’s decline of 33.6% and the S&P 500’s decline of 16.9%.

One-Yr Worth Efficiency

Picture Supply: Zacks Funding Analysis

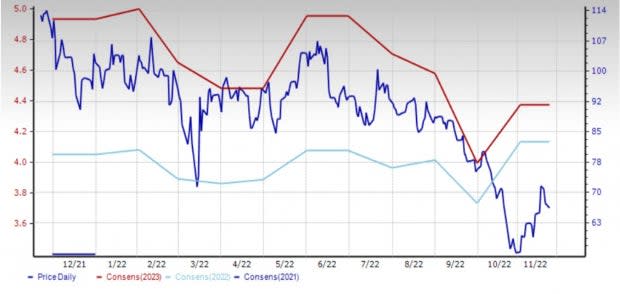

Business’s Present Valuation

Whereas lots of the gamers are nonetheless making losses, the trade as an entire continues to generate income. Subsequently, on the idea of ahead 12-month price-to-earnings (P/E) ratio, we see that the trade is at present buying and selling at a 30.7X a number of, properly beneath its median stage of 52.6X over the previous 12 months. The S&P 500’s P/E is nonetheless simply 17.7X (the median worth over the previous 12 months is 17.9X). The trade can be overvalued in comparison with the sector’s forward-12-month P/E of 21.1X (at its median stage over the previous 12 months).

The trade has traded within the annual vary of 75.1X to 29.0X, because the chart beneath reveals.

Ahead 12 Month Worth-to-Earnings (P/E) Ratio

Picture Supply: Zacks Funding Analysis

3 Shares Price Contemplating

NetEase, Inc. (NTES): Hangzhou-based NetEase gives on-line companies specializing in various content material, together with video games, music, different companies and schooling (dictionary, translation and together with a variety of good gadgets) in China. Its services and products are targeted on group, communication and commerce.

NetEase is at present constructing its worldwide enterprise by way of recent gaming content material that appeals to a global viewers. For this function, it has additionally established its personal studios in Japan, Europe and North America, and is constructing artistic expertise in these areas. It’s also increasing its attain past PCs and cell gadgets to consoles and facilitates gameplay seamlessly throughout gadgets, which additional helps to develop the consumer base. Its academic instruments are very talked-about, as seen from the excessive income progress price. The music enterprise continues to develop with day by day and month-to-month customers holding regular even because the advertising-supported tier returns. Plus, the content material library continues to develop.

Shares of this Zacks Rank #2 (Purchase) firm have sunk 41.5% over the previous 12 months. The Zacks Consensus Estimate for the 2022 EPS loss has elevated 37 cents (8.5%) within the final 60 days. The 2023 earnings estimate has elevated 35 cents (7.6%).

Worth and Consensus: NTES

Picture Supply: Zacks Funding Analysis

RingCentral, Inc. (RNG): Belmont, CA-based RingCentral gives software-as-a-service options that allow North American companies to speak, collaborate and join. The corporate gives enterprise cloud communications and call heart options. It caters to enterprises, SMBs, professionals and others throughout a broad vary of industries together with monetary companies, schooling, healthcare, authorized companies, actual property, retail, know-how, insurance coverage, building, hospitality, and state and native authorities.

RingCentral is rising on the again of a number of megatrends, together with the pandemic-induced shift to hybrid work, the growing adoption of mobility options by companies and the more and more distributed workforces, all of that are resulting in the elevated want for unified communications and call heart options. When these are cloud-enabled, the entire thing is best built-in, safer, extra environment friendly and value environment friendly. With an ecosystem of over 75,000 builders, over 150 pre-built telephony apps and over 330 pre-built apps as unified communications and call heart options, it is no shock that Gartner has RingCentral within the management quadrant of its newest report. The corporate is already producing a recurring income run price of $2 billion and appears set to simply eclipse that subsequent 12 months.

All this does not in fact doesn’t suggest that the corporate just isn’t seeing the financial slowdown and labor price inflation that the remainder of the market is seeing. Administration has been rationalizing the workforce to align it with the altering market state of affairs. But it surely would not take away from the truth that this can be a quickly increasing market the world over with a really low (single-digit) penetration price, in line with Synergy Analysis. Moreover, Synergy estimates that RingCentral is the chief in UCaaS with over 20% market share primarily based on paid seats, which is double the second and third place distributors. So, there may be great scope for progress.

Shares of this Zacks Rank #2 firm are down 83.5% over the previous 12 months. Its 2022 estimate is up 4 cents (2.1%) within the final 60 days. The 2023 estimate is up 28 cents (11.2%) throughout the identical time interval.

Worth and Consensus: RNG

Picture Supply: Zacks Funding Analysis

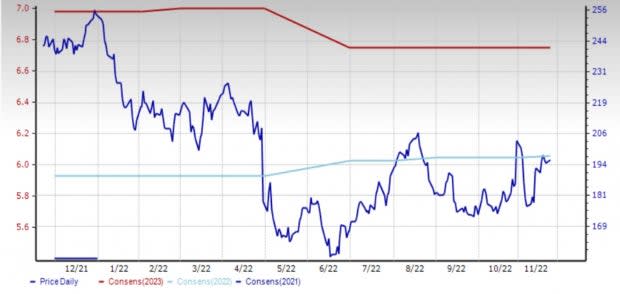

VeriSign, Inc. (VRSN): Reston, Va-based VeriSign gives Web infrastructure companies, together with primarily area identify registry companies and in addition infrastructure assurance companies.

Verisign is benefiting from value will increase of as much as 7% pursuant to the Third Modification to the .com Registry Settlement with ICANN and as much as 10% within the .web registrations. The regular nature of the enterprise that’s tied to digital transformation results in comparatively regular money flows. Nonetheless, like each different firm, rising prices, the broader financial slowdown and weaker enterprise in China are additionally weighing on it. Competitors from Google’s free public area identify service can be a priority.

Shares of this Zacks Rank #2 firm have dropped 19.1% over the previous 12 months. The Zacks Consensus Estimate for the 2022 EPS is up a penny whereas that for the 2023 EPS is unchanged within the final 60 days.

Worth and Consensus: VRSN

Picture Supply: Zacks Funding Analysis

Need the newest suggestions from Zacks Funding Analysis? At the moment, you possibly can obtain the 7 Greatest Shares for the Subsequent 30 Days. Click on to get this free report

VeriSign, Inc. (VRSN) : Free Inventory Evaluation Report

NetEase, Inc. (NTES) : Free Inventory Evaluation Report

Ringcentral, Inc. (RNG) : Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis